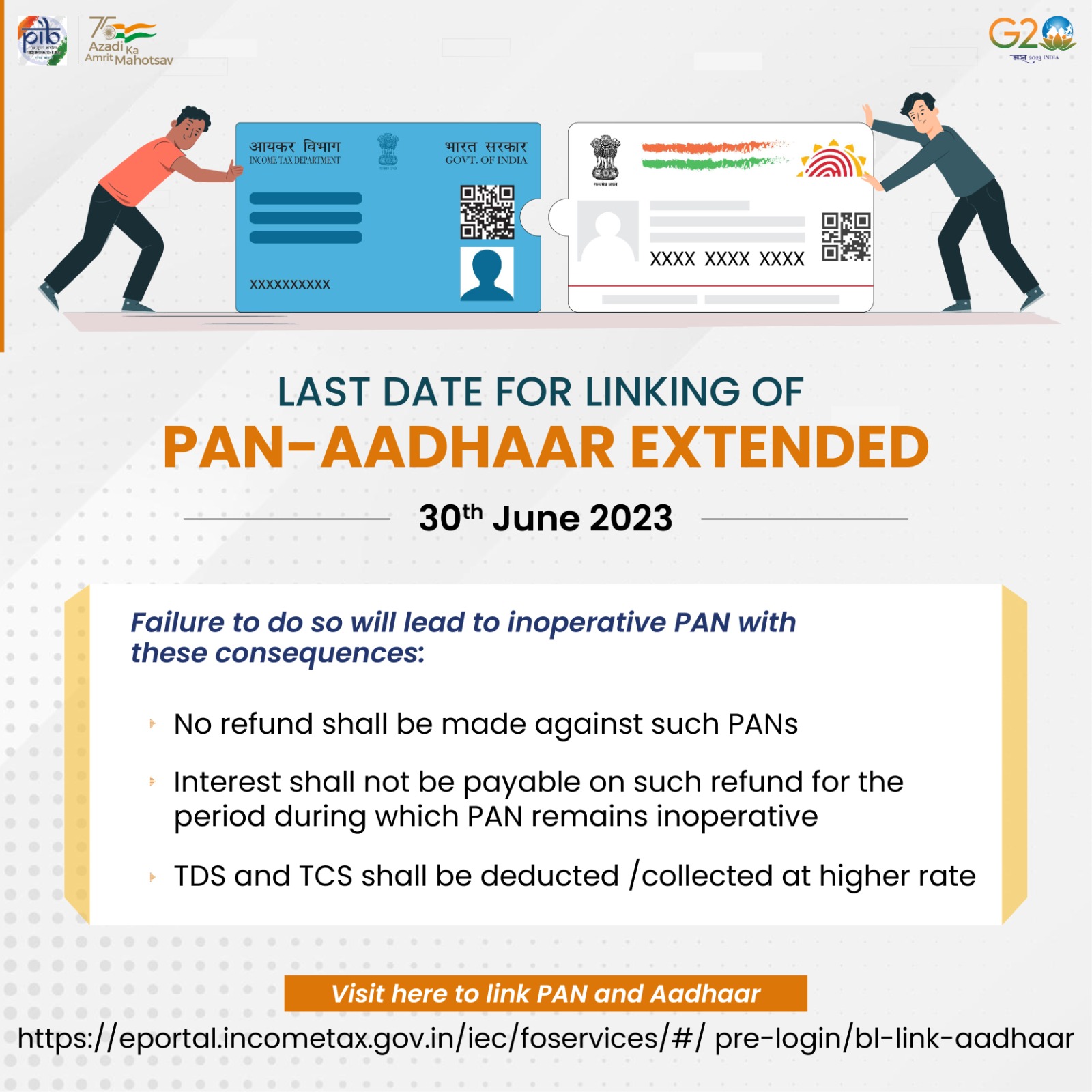

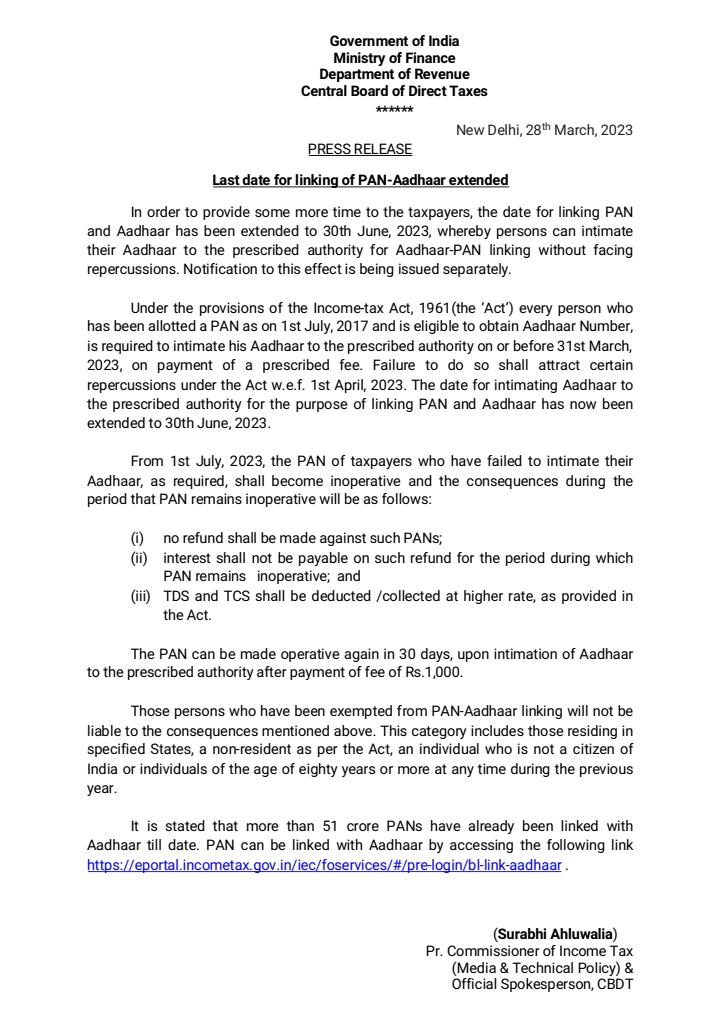

In a recent development, the Central Board of Direct Taxes (CBDT) has extended the deadline for linking PAN (Permanent Account Number) with Aadhaar to June 30, 2023. This decision has been taken in view of the ongoing COVID-19 pandemic and the difficulties faced by taxpayers in complying with the previous deadline.

The previous deadline for linking PAN and Aadhaar was September 30, 2021, which was later extended to December 31, 2021. However, due to the persisting pandemic situation, the CBDT has further extended the deadline to June 30, 2023.

It is important to note that the linking of PAN and Aadhaar is mandatory for taxpayers and non-compliance can lead to penalties and other legal consequences. Therefore, taxpayers are advised to link their PAN and Aadhaar before the new deadline of June 30, 2023.

The process of linking PAN and Aadhaar is simple and can be done online through the income tax department’s e-filing portal or through SMS. Taxpayers can link their PAN and Aadhaar by entering their details on the portal or by sending an SMS to a designated number.

Overall, the extension of the deadline for linking PAN and Aadhaar is a welcome move for taxpayers who have been struggling to comply with the previous deadlines due to the COVID-19 pandemic. It provides them with more time to complete this mandatory requirement without facing any penalties or legal consequences.

HOW TO CHECK STATUS ?

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status